Shipping From China To The World

At the beginning of the new year, the most frequently asked question after work is about RCEP. I really want to write an article to introduce it to you, but my ability is limited, and the scope of RCEP is too large. I can only answer some of the most frequently asked questions by my friends. hopefully this can provide beneficial help to everyone!

Question 1: In addition to bilateral tariff reduction and exemption, what role does RCEP have?

answer:

Bilateral trade tariffs will take 16-21 years (varies for different countries), and some commodities will be gradually reduced to zero tariffs.

1. Trade in services: gradually realize national treatment and non-differentiated most-favored-nation treatment.

2. Investment: Except for national treatment and most-favored-nation treatment, no unreasonable operational requirements shall be prescribed.

3. Technical cooperation: Economic and technical cooperation shall be carried out according to the capability and development level of each country to narrow the gap between the two sides.

4. Personnel movement: permit temporary entry or extended residence time for personnel from contracting parties, and simplify application procedures to ensure reasonable fees.

5. E-commerce and data exchange: Facilitate trade more easily, protect consumer interests and privacy, and zero tariffs on electronic data transmission.

6. Small, medium and micro enterprise development: strengthen cooperation, encourage innovation, and promote information exchange and sharing, including laws and regulations and information that is conducive to business transactions.

Question 2: Under what conditions can I enjoy the tariff preference of RCEP?

answer:

As long as the goods are imported and exported between China and Japan, they can enjoy this discount, whether it is an e-commerce business (without an actual consignee) or an actual importer, as long as the relevant materials are submitted.

Question 3: Is there a website where I can check which HS CODEs can enjoy tariff concessions?

answer:

https://www.kanzei.or.jp/statistical/tariff/headline/hs2dig/e/01

Question 4: In addition to reducing or exempting bilateral tariffs, what role does RCEP have?

answer:

For goods imported into Japan, in addition to the normal packing list invoice and bill of lading, a certificate of origin is required. (When the product is not 100% produced in China, for example, if some products are produced in Vietnam and some are produced in China, you need to inform the Japanese customs clearance bank in advance, and the customs clearance bank will confirm with the customs in advance and then inform you about the discount.) Other than that, there are no special changes.

Question 5: After the implementation of RCEP, will China's export declaration data and Japan's import declaration data be exchanged? Besides, also

answer:

At present, there is no data exchange, and it is unclear whether it will be exchanged in the future.

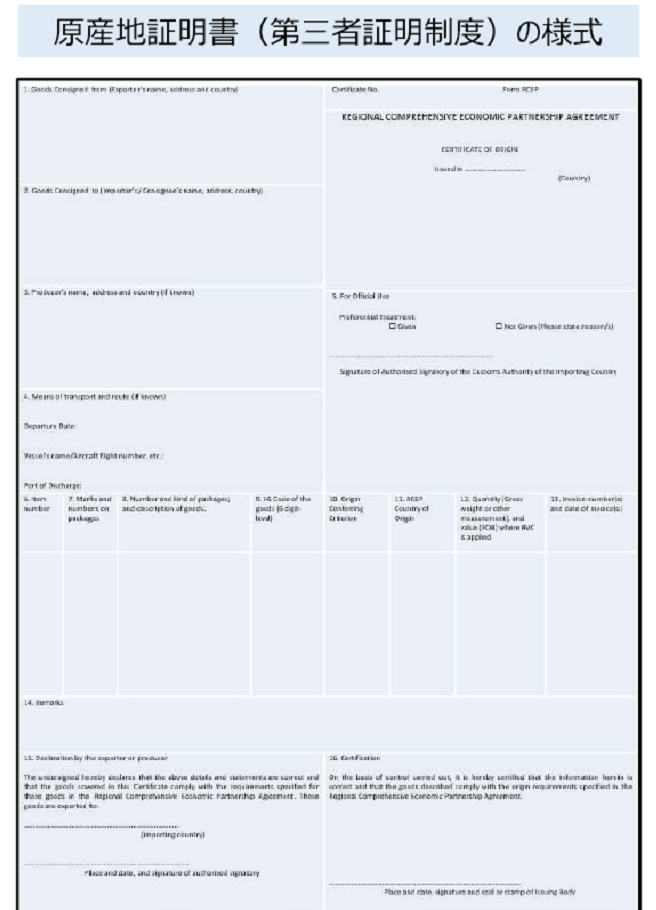

Question 6: When applying for RCEP, is there a special version of the certificate of origin?

answer:

RCEP dedicated version, please refer to the following picture:

Picture title 5: After the implementation of RCEP, China's export declaration data and Japan's import declaration data will be exchanged

In principle, the original documents need to be submitted, but due to concerns about the mailing time and other issues, you can first provide a clearer electronic version of the documents for customs clearance overseas, and then mail the original documents to the customs clearance bank.

Question 7: For the declared amount below 200,000, do I need a certificate of origin to apply for RCEP?

answer:

If the declared amount is less than 200,000 yen, it is a small amount declaration. In this case, you only need the MADE IN CHINA logo on the product packaging. In addition, if RCEP tax reduction is required, it cannot be declared together with other commodities. It needs to be declared in a separate column or the commodities that enjoy RCEP discounts must be declared in one column.

Question 8: After the implementation of RCEP, which commodity tax rates have changed significantly?

answer:

Changes in tax rates on products exported from China to Japan

For example:

Question 9: Is there any change in the tax rate for goods that were originally 0 tariffs?

answer: No change, still 0 tariffs.

Question 10: What is the goal of RCEP to reduce tariffs?

answer:

From January 1, 2022, RCEP began to implement tariff reduction. Among the goods exported from China to Japan, 24.9% of the tax items will achieve zero tariffs (after 16 years), and 55.5% of the tariff items imported from Japan to China will be reduced. is 0.

Hope the above article can help you! If you still have questions about RCEP, you can always add our official WeChat: FCSL01 to contact us, or follow our official account.

We also look forward to your interaction with us. Thank you for your attention, Baitong is your most satisfactory Japanese cross-border logistics service provider.

Mar 09,2022

At the beginning of the new year, the most frequently asked question after work is about RCEP. I really want to write an article to introduce it to you, but my ability is limited, and the scope of RCEP is too large. I can only answer some of the most freq

Mar 09,2022

Yes, our service cover all major ports in China areas , like Shanghai / Qingdao / Ningbo/Shenzhen/Guangzhou/Hong Kong etc, Our warehouse facility in these ports are more than 5,000 square meter.

Mar 09,2022